A Biased View of Feie Calculator

Table of Contents7 Simple Techniques For Feie CalculatorFeie Calculator Fundamentals ExplainedThe Definitive Guide to Feie CalculatorThings about Feie CalculatorHow Feie Calculator can Save You Time, Stress, and Money.

He sold his U.S. home to develop his intent to live abroad permanently and used for a Mexican residency visa with his wife to help meet the Bona Fide Residency Examination. Neil directs out that acquiring residential property abroad can be testing without initial experiencing the place."We'll certainly be beyond that. Also if we return to the United States for medical professional's visits or service phone calls, I doubt we'll spend more than 30 days in the US in any given 12-month period." Neil emphasizes the value of strict tracking of U.S. brows through (Form 2555). "It's something that individuals require to be truly thorough concerning," he says, and recommends expats to be mindful of usual blunders, such as overstaying in the U.S.

The Feie Calculator Ideas

tax commitments. "The reason united state tax on worldwide income is such a large deal is since many individuals forget they're still subject to united state tax even after moving." The united state is among the few nations that taxes its citizens no matter where they live, meaning that even if an expat has no earnings from U.S.

income tax return. "The Foreign Tax Credit score permits people operating in high-tax nations like the UK to counter their U.S. tax responsibility by the amount they've currently paid in tax obligations abroad," states Lewis. This ensures that expats are not taxed twice on the exact same revenue. Those in low- or no-tax nations, such as the UAE or Singapore, face additional hurdles.

Getting The Feie Calculator To Work

Below are several of look at this web-site one of the most regularly asked concerns concerning the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) enables united state taxpayers to omit as much as $130,000 of foreign-earned income from government income tax obligation, lowering their united state tax obligation obligation. To receive FEIE, you have to satisfy either the Physical Visibility Examination (330 days abroad) or the Authentic Home Examination (show your primary home in a foreign country for a whole tax year).

The Physical Presence Test needs you to be outside the U.S. for 330 days within a 12-month duration. The Physical Presence Examination likewise requires united state taxpayers to have both a foreign income and an international tax home. A tax home is defined as your prime area for company or employment, no matter your family members's residence.

Some Known Facts About Feie Calculator.

An income tax treaty between the united state and an additional country can help protect against dual taxes. While the Foreign Earned Revenue Exemption reduces taxed earnings, a treaty may give fringe benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a needed filing for united state citizens with over $10,000 in international monetary accounts.

Eligibility for FEIE relies on meeting specific residency or physical visibility examinations. is a tax consultant on the Harness platform and the creator of Chessis Tax obligation. He belongs to the National Organization of Enrolled Brokers, the Texas Culture of Enrolled Professionals, and the Texas Culture of CPAs. He brings over a years of experience functioning for Large 4 firms, encouraging migrants and high-net-worth people.

Neil Johnson, CPA, is a tax obligation advisor on the Harness system and the founder of The Tax Guy. He has over thirty years of experience and currently focuses on CFO services, equity settlement, copyright tax, cannabis taxes and divorce relevant tax/financial preparation matters. He is a deportee based in Mexico - https://www.twitch.tv/feiecalcu/about.

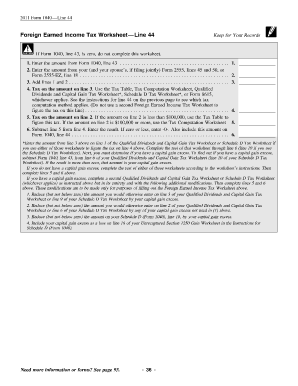

The foreign gained income exemptions, in some cases referred to as the Sec. 911 exemptions, exclude tax obligation on wages made from functioning abroad.

An Unbiased View of Feie Calculator

The income exemption is now indexed for inflation. The maximum annual earnings exemption is $130,000 for 2025. The tax obligation advantage leaves out the earnings from tax obligation at bottom tax obligation prices. Formerly, the exemptions "came off the top" minimizing revenue based on tax obligation on top tax obligation rates. The exemptions might or may not decrease revenue used for other functions, such as IRA limitations, kid credit histories, individual exemptions, and so on.

These exclusions do not excuse the salaries from US taxation but merely supply a tax obligation decrease. Keep in mind that a solitary individual functioning abroad for all of 2025 that earned about $145,000 without any various other revenue will certainly have taxable earnings decreased to zero - efficiently the exact same response as being "tax obligation free." The exclusions are calculated every day.

Comments on “Not known Factual Statements About Feie Calculator”